About HQ Boardroom Discussions: the HQ Boardroom Discussion is an event where Hatch Quarter hosts an open and intricate discussion with top industry leaders. This is the second Boardroom Discussion we have hosted and is focused on government incentives, grants and tax schemes specifically for startups. The aim of such discussions is to incite deep conversations and gain information which is hard to come by, through facilitating the conversations with industry experts and business leaders.

Year on year, there are various grants, incentive programs, and initiatives by both federal and state governments to propel our innovation industry forward and maintain the advantage it provides our economy.

On the 11th of June 2020, over 50 innovators and investors tuned into the HQ Boardroom Discussion with Hank Sciberras: Government Incentives and Startups. Hank, Partner at Deloitte and Victorian Practice Leader of the Research and Development (R&D) Tax and Incentives Group, covered invaluable information about the Early Stage Innovation Companies (ESIC) scheme, and R&D Tax Incentive Program and general tips about government support programs and grants.

Hank also has his own take on the entrepreneurial journey as he started his career as an engineer, teamed up with friends from universities and worked on developing deep ultraviolet laser technology for eye surgery. Throughout their journey, Hank and his team continuously faced the turbulence brought about by financial crises. He recommended conducting a continuous review of finances and avoiding complacency in any stages of the startup’s development, i.e continuously managing the company’s finances as if you’re still a startup with slim budgets. For Hank and his startup, what majorly boosted their chances of success was sourcing capital from the United States, listing on the Australian Securities Exchange (ASX), and engaging with the government incentives available at that time (20 years ago).

With Hank’s startup experience and now a Victorian Practice Leader of the R&D Tax and Incentives Group, Hank is uniquely positioned to introduce entrepreneurs and investors to government incentives, and the opportunities in that arena. Here are the key takeaways from the session.

The Startup Ecosystem

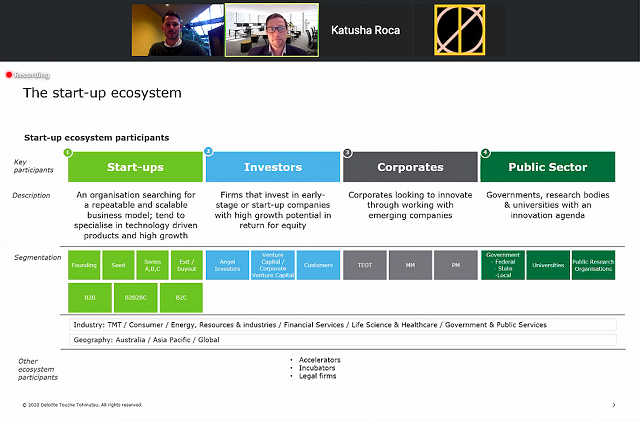

It is helpful to view the startup ecosystem by the key stakeholders and their contribution to startups:

Startups

Investors

Corporates

Public Sector.

Understanding how these key players interact with each other is important and forms the basis and purpose of government support programs. The main two which are focused on startups are the ESIC and the R&D Tax Incentive. These two schemes exist in the same mode year-to-year.

Early Stage Innovation Company (ESIC) Scheme

From the 1st of July 2016, an eligible entity investing in a qualifying Early Stage Innovation Company (ESIC), may be eligible for tax incentives; and entities that acquire newly issued shares in an Australian ESIC may receive a non-refundable carry-forward tax offset of 20% of the value of their investment, subject to a maximum offset cap amount of $200,000.00.

This incentive is for the investor and qualifying as an ESIC helps the founder/founding team to raise capital while retaining more equity, The main two criteria to meet are:

-

Early Stage

-

Innovation

Qualifying as an Early Stage company is relatively easier to meet compared to the Innovation criterion. The Innovation criterion requires that the company must be genuinely focused on developing one or more new or significantly improved innovations. The Australian Tax Office (ATO) and other regulatory bodies need to see that startups can provide evidence of this and prove their true intentions.

This can be proved via two tests: the 100 Point innovation test or the principles-based test. Hank recommends the 100 point test, as the principles-based test can be subjective. With the 100 point test, it is best to compile documentation to accumulate more than 100 points to increase certainty. With the principles-based test, having a patent is helpful in demonstrating competitive advantage and the true intentions of building something innovative.

Startups could either engage with sophisticated investors or retail investors. Sophisticated investors can provide a letter from an accountant specifying their status. Some limitations on retail investors include not being able to invest with more than $50,000.00 into the startup. If a startup is going to endeavour on the ESIC scheme, Hank recommends engaging with sophisticated investors over retail investors as sophisticated investors have fewer limitations.

From Hank’s experience, it is quite often that Angel investors come forward to startups they are interested in, to identify the startup’s eligibility and interest in the ESIC scheme. He also reflected on the fact that by the time sophisticated investors decide to invest in a startup, they do not see it as a roll of a dice, but rather an initiative they’re expecting a return on. So they view the ESIC scheme tax offset as a significant incentive for investing in a startup.

Research and Development (R&D) Tax Incentive

There are two different levels of the R&D tax offset available: cast refundable at 43.5% and non-refundable at 38.5%. This incentive is one of the oldest and has been available since the mid-1980s. The R&D tax incentive claim can be compartmentalised into four different areas:

-

R&D Entity

-

R&D Activities

-

R&D Expenditure

-

Contemporaneous Documentation

It is recommended that if you’re an entrepreneur, you should ensure that you meet the R&D Entity criteria first (then R&D Activities followed by R&D Expenditure). This is because if a startup does not meet the criteria of an R&D Entity, then it would be pointless to spend the time on the other points.

If the R&D Entity eligibility is met, then working on compiling documentation for the R&D Activities and Expenditure is worthwhile. It is recommended that the basic R&D documentation is clear and well-reported. Hank explained that the process of documentation should be almost as basic and clear as a Year 6 science report where the hypothesis, experimental activities equipment etc. are listed and described. More often than not, if there was a dispute case for R&D Activities eligibility with the ATO or AusIndustry, then it is most likely because there was a lack of documentation and poor reporting.

It was also well-highlighted that some of the key eligibility criteria for R&D Activities are:

- it is experimental

- the outcome is unknown,

It cannot be known in advance based on current knowledge, information and experience, and can only be determined via a systematic progression and research activities.

Some final notes are that regulators expect more sophistication in reports and documentation as the business matures, and startups should fully understand the impacts of disposing of R&D results (e.g., selling IP), the impact on assessable income and the impact of R&D tax offsets on franking debits.

Government Grants

Grants are very valuable, but they do take up a lot of time. Therefore, it is important to carefully consider grants relevant to your startup, and not deep diving into every available one. It was highlighted that the success rate for these grants is very low, and thus, it is important to go for the ones which would be beneficial to your startup and you are eligible for.

Some key tips for government grants:

-

GrantConnect lists all currently available government grants.

-

“Review and assess correctly your eligibility for the grant.”—It is highlighted that 10 per cent of applications missed one of the criteria and resulted in being ineligible.

-

“Thoughtfully address the merit criteria.”—it is important to not only ensure to meet each merit criteria but to also be competitive in each one.

-

“Build and rely on relationships with government stakeholders as early as possible during the submission of the grant application process”—speak, email or talk with the regulators and form some rapport. This is not in any way a form of lobbying, but it is to help the assessors understand the startup and become familiar with the organisation and what you do.

The team at Hatch Quarter is grateful to the Deloitte team for helping us organise this event, and supporting our mission of empowering founders through knowledge.

For the full webinar and discussion with Hank, you can access the video recording via the link here, and the presentation slides linked here.

Disclaimer: The information provided in the webinar and in this blog is strictly for educational purposes to explain government incentives and startups, and it does not constitute investment, accounting, financial, legal or tax advice. It has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.