On the 12th of August 2021, Hatch Quarter hosted its seventh HQ Boardroom Discussion on the topic of alternate employee equity structures with guest speaker Jon Lee (Director at EY). Jon Lee is a Director in EY’s People Advisory Service (PAS) practice. This discussion allowed for profound insights from industry experts and a Q&A from the audience in order to gain a deeper knowledge of equity schemes.

For startups and established companies, employee equity structures (EES) allow companies to incentivise potential talent while providing them with the opportunity to invest and share in the company’s success. It is essential for companies to understand what is an options plan, the ”start-up” tax rules, the varying types of equity structures, and the process of designing and implementing an employee equity plan. Here is the key information covered in the event.

Recap: “start-up” Tax Rules and Options Plan

What are the “start-up” tax rules?

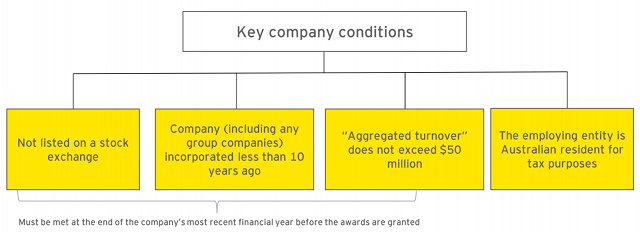

Before employers decide to implement employee equity plans, there are certain tax rules and implications for the startup to fulfill. The key company conditions are as follows:

Once these conditions are met and the plan is structured correctly, startups are then entitled to taxation opportunities that of:

- Employees do not get taxed until the shares have been sold

- Any gains any individual makes in respect to a startup are all subjected to capital gains tax (CGT)

- When you hold equity for more than 12 months and you make a capital gain, only half the gain are subjected to tax (50% CGT discount) (source)

What is a “start-up” option plan?

Due to its simplicity and the many advantages that come with it, the ‘Option Plan’ is most commonly used with approximately 95 to 98% of startups implementing this plan for its employees.

Options are frequently used to incentivise growth with employees wanting their share price to grow with the company. The ‘Option Plan’ is simply a contract where employees have the right to acquire shares at a fixed price, not having to buy shares upfront. By choosing this plan, its advantages include the easy maintenance of an option register which is a requirement under the Australian Corporations Act (source) and the ease of mind that if the employee does not meet the vesting conditions of the company, the option contract would simply cease to apply.

What are the alternate equity structures?

There are generally four possible structures that private companies use to incentivise their employees as shown below and it becomes increasingly complex to implement as the list goes down:

1) A common structure that early-staged companies implement is the performance rights/zero-priced options. The main reasons companies choose to use this structure is firstly due to its zero-exercise price, where employees do not need to pay anything to acquire the share. Second of all, it is a simple structure for employers to communicate to their employees where employers provide them with options if they meet the vesting conditions and they will receive a certain amount of shares for free. Overall, this option provides employees with certainty that despite any circumstances and if the company meets the vesting conditions, this option and award will always be worth something—avoiding the situation where the share price falls down below the exercise price, that option becomes worthless.

2) The premium-priced option is where a company issues the right to purchase shares at a point in time in the future, at a specified exercise price and subject to vesting conditions. Compared to other options where employees are required to purchase shares at market value, this option plan offers an alternative valuation methodology (source). This option has an exercise price that is “out of money'', meaning there are alternative ways to value options and varies the amount employees would be taxed. Companies who are eligible for premium-priced options are those who meet the conditions for the startup rules and will need the additional 3 year holding period, Any gains that are realised at the time of sale, all are subject to CGT, as long as the company can fit under the startup conditions. An advantage for this option plan is that compared to the performance rights option which is subject to income tax, there are additional tax implications, however, for premium, there is no payroll tax cause the option is worth zero meaning there is no reporting to ATO cause that option is worth nothing at the time of grant.

3) Purchased options is not a common structure for startups due to their complexity and are therefore implemented by companies who are owned by VC firms or private equities; companies who have greater resources in dealing with the complex process. These options are purchased by employees at the tax market value and it is not subjected to income tax but instead to CGT. The perplexing issue surrounding this option is having to work out the purchase price and its implications for tax in addition to valuing your shares and funding requirement.

4) Simply put, a loan share is an arrangement where a company provides an interest-free loan to its employees to buy shares at the company at market value. This structure is most appropriate for companies that do not fit under the startup rules as it usually does not issue shares at a discount under a loan funded share plan, whereas options or performance rights are often issued at a discount to their market value under the start-up option schemes or tax-deferred option schemes or performance rights plans. An advantage is that these loans are “limited recourse'' in nature, meaning the employer only has recourse to the shares in the event of a default or the proceeds from the sale of those shares (source). There are, however, many complexities with this option involving tax implications. Given the case where companies already have employees who are shareholders or options holders, loans given out to these employees will be treated as dividends by the ATO, overall bringing greater costs with legal and advisory fees.

How to design and implement an Employee Equity Plan?

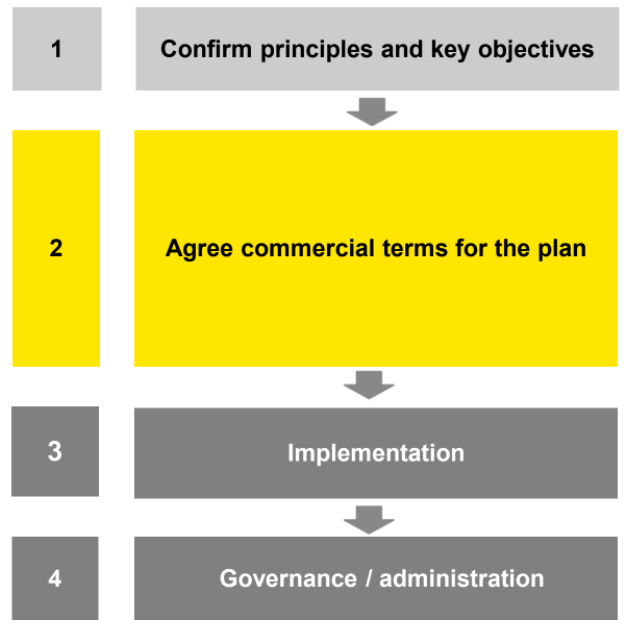

After deciding on a structure, the final step is to design and implement the chosen plan. The key steps that Jon Lee had highlighted are “confirming principles and key objectives”, “agreeing on commercial terms”, “implementing and properly governing” and “administering your chosen plan”.

It is critical that employers are on the same page when considering what are the key objectives of the plan they want to implement and what the plan is intended to achieve. Whether it be the plan is targeted for certain employees they want to incentivise or for the entire company to increase their interest in staying with the company. Either way, a clear and mutual understanding of the plan needs to be in place.

Next, employers would need to agree on the commercial terms for the plan, some key features include:

- Who is eligible to participate?

- What are the appropriate vesting conditions?

- What is the treatment if an option-holder leaves?

- When can participants realise value from the options (e.g., should value only be realised on a liquidity event?)?

When thinking up the commercial terms, it is also important to consider other possibilities that may occur outside the key features, for example, what if a new investor comes in and takes up a major share in the company—how would your company work around that?

After the terms have been confirmed, employers then move onto the ‘implementation’ stage where the documentation of a drafted plan would be produced and employers should be seeking tax and legal/regulatory advice to fully understand the company obligations when implementing their plan such as having to submit a prospectus document and drafting other relevant documents that both capture the company’s commercial objectives and complies with Australian Regulatory Security Law provision (source).

The final stage is governance and administration and Jon Lee had encouraged employers to ask themselves:

- Who will be managing the plan? (e.g., board approval)

- Who will be managing the tax/legal related issues?

- Who will be responsible for assisting employees with the EES scheme

To maximise the effectiveness of the chosen EES, companies need to ensure that proper governance and appropriate administration is carried throughout the plan to benefit both the employers and their employees.

Overall, there are many option plans to choose from with varying complexities, challenges, tax implications and benefits. All it is, is to fully understand how each plan works, and which will be the best fit for your company to attract and incentivise talent where then, the opportunities are infinite for your company and its employees.

Disclaimer: The information provided in the webinar and in this blog is strictly for educational purposes to explain government incentives and startups, and it does not constitute investment, accounting, financial, legal or tax advice. It has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.