We’ve all heard of the tales of startups where the team works out of a garage in someone’s house or in a small apartment. When you’re passionate, any usable space with electricity and Wi-Fi will do! Some expenses, however, can’t be skimped on. If you are building a product, you’ll need money to buy materials. If you’re building an app, you might need money for either graphic design or app development.

Don’t forget—time is also money, so if you’re planning on working on the business yourself, you need to think about how much time you can afford to put to your own startup. If you do it for too long without pay, you might not have enough to pay your rent! A common experience shared by people who work on their own businesses full time is how quickly your savings can disappear, simply due to the costs of living. It’s for these reasons that it’s important to research, plan, and estimate how much time and money you need to get your startup off the ground.

There are two stages at which you typically need capital:

-

To set up your business: This includes money needed to register your business, develop a prototype, design your logos, or purchase equipment.

- To grow: When you’ve proven your idea and have started to generate sales, but now need investment to further scale your business.

To figure out how much money you need to launch your startup, think about:

> How much you need to spend to build your prototype? If it’s a physical product, then how much will it cost to manufacture?

> If it’s a service, then what people do you need?

> If it’s SAAS, then how much will it cost to have your technology developed?

> What you’ll need to spend on branding and marketing?

> Legal and accounting costs.

> Contractors/consultants to provide you with the services you need.

> And finally, how much of your time (as a team, if you’re working with partners) you can commit to supporting the business.

Once your startup is starting to operate as a business and you begin to develop a reasonably good understanding of how your business operates, how much it costs to run, and what your profit margins are, you may be in a position where you want additional capital to expand your business.

Some of the questions you may be considering at this point include:

> Where do you want to expand to? And how?

> What are your financial projections over the next 3, 5, or 10 years?

> How much faster will your profits come with investment?

> Where exactly will you spend any investment? And how will it impact your revenue?

> Will you need to raise money again in the future?

The Stages of Raising Capital

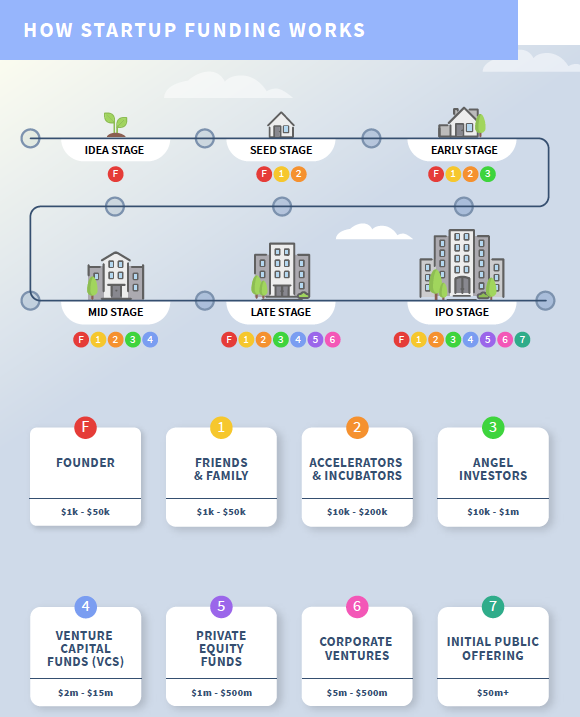

Raising capital and funding rounds is a big business in the startup industry and can make or break startups. Before you start reaching out to investors, it’s important to understand at what stage you need to be to approach different types of investors.

For example, whilst Angel Investors and Venture Capitalists are the investors commonly associated with millions of dollars, many won’t even talk to you unless you’re already turning over millions of dollars. In other words, approaching them with ‘just an idea’ is probably going to be a waste of their time!

Ask Yourself

• Do you need money to start your idea or to grow your startup?

• How will you spend this money?

• How will this money grow the business and generate better outcomes for your business?

• What will be the return of investment of this money? What are you willing to give in return for this money?

Grants and Funding

There is another option for startups to raise capital, and that’s through government grants and funds. The Victorian Government, city councils and various non-profits provide an array of grants to business owners looking to launch or scale up their operation. These grants won’t always be in the form of capital however, some may be in the form of services, mentorship, or professional support.

These can be just as valuable—if not more—than simply accessing money. From accessing startup incubators to professional support services, grants provide an opportunity to achieve your next step more simply and quickly.

The following websites provide comprehensive databases of available Australian grants, as well as support to help with the application process:

Crowdfunding

Crowdfunding is a popular fundraising route for many aspiring startups, especially in the early stages of their startup journey. Crowdfunding works by launching a time-limited campaign that raises funds from a large number of people who are interested in your idea and want to contribute small amounts of money towards your goal.

In return for their contributions, startups often reward people with the product or service that they are creating, with larger rewards for larger contributions. Common examples are priority access to first production models or technology, discounted prices to the final product, or even meetings with the founders. Some startups also offer equity from the company, in return for monetary contributions. However, there are strict regulations associated with this approach, and it is typically done at later stages of your startup.

Crowdfunding for a reward can be a useful way of determining whether there is interest in your idea. A lot of preparation is often required to undertake a successful crowdfunding campaign, and it is often recommended that you have an early prototype to demonstrate to the market.

Whilst you may be familiar with Kickstarter or Go FundMe, these are international platforms. For local Australian platforms, consider Pozible and Birchal. Hatch Quarter also provides a Pozible platform tailored to the international entrepreneur community.

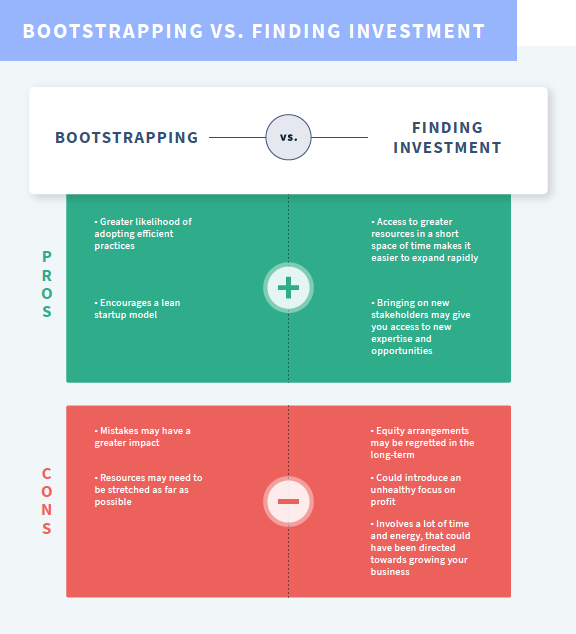

Bootstrapping vs. Raising Capital Investment

Raising capital investment is a path many startups go down and it is also what gets the most amount of public attention. However, this isn’t the only path. The definition of bootstrapping (or pulling yourself up by your bootstraps) basically refers to you growing your business purely from the capital that you inject - your own savings and effort - and then grow the business from the revenue and profits you receive.

Some of the most famous businesses around today started by bootstrapping their businesses. Facebook, Apple, and Microsoft all had their origins in a bootstrap model, driven at its core by an entrepreneur.

Ask Yourself

-

Will your business be able to cover the cost of operating the business without the need of additional capital?

-

What else might the business need capital for? For example, spending on research and development?

-

Will an investment make the process of delivering your solution more efficient? Is it worth it to raise money and have the responsibility to the investor at this stage?